Page 262 - Social Enterprise A New Business Paradigm for Thailand

P. 262

baht and 1–2 million baht, representing approximately 36% and 22%, incurred net losses,

averaging 0.21 million baht and 0.56 million baht, respectively (0.94 – 1.15 and 0.94 – 1.50).

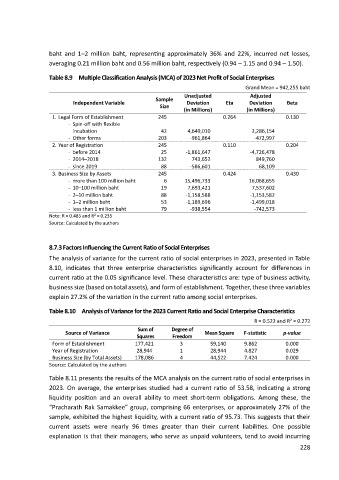

Table 8.9 Multiple Classification Analysis (MCA) of 2023 Net Profit of Social Enterprises

Grand Mean = 942,255 baht

Unadjusted Adjusted

Sample

Independent Variable Deviation Eta Deviation Beta

Size

(in Millions) (in Millions)

1. Legal Form of Establishment 245 0.264 0.130

- Spin-off with flexible

incubation 42 4,649,010 2,286,154

- Other forms 203 -961,864 -472,997

2. Year of Registration 245 0.110 0.204

- before 2014 25 -1,861,647 -4,726,478

- 2014–2018 132 743,652 849,760

- since 2019 88 -586,601 68,109

3. Business Size by Assets 245 0.424 0.430

- more than 100 million baht 6 15,496,733 16,068,655

- 10–100 million baht 19 7,693,421 7,537,602

- 2–10 million baht 88 -1,158,588 -1,153,582

- 1–2 million baht 53 -1,189,696 -1,499,018

- less than 1 million baht 79 -938,554 -742,573

Note: R = 0.485 and R² = 0.235

Source: Calculated by the authors

8.7.3 Factors Influencing the Current Ratio of Social Enterprises

The analysis of variance for the current ratio of social enterprises in 2023, presented in Table

8.10, indicates that three enterprise characteristics significantly account for differences in

current ratio at the 0.05 significance level. These characteristics are: type of business activity,

business size (based on total assets), and form of establishment. Together, these three variables

explain 27.2% of the variation in the current ratio among social enterprises.

Table 8.10 Analysis of Variance for the 2023 Current Ratio and Social Enterprise Characteristics

R = 0.522 and R² = 0.272

Sum of Degree of

Source of Variance Mean Square F-statistic p-value

Squares Freedom

Form of Establishment 177,421 3 59,140 9.862 0.000

Year of Registration 28,944 1 28,944 4.827 0.029

Business Size (by Total Assets) 178,086 4 44,522 7.424 0.000

Source: Calculated by the authors

Table 8.11 presents the results of the MCA analysis on the current ratio of social enterprises in

2023. On average, the enterprises studied had a current ratio of 53.58, indicating a strong

liquidity position and an overall ability to meet short-term obligations. Among these, the

“Pracharath Rak Samakkee” group, comprising 66 enterprises, or approximately 27% of the

sample, exhibited the highest liquidity, with a current ratio of 95.73. This suggests that their

current assets were nearly 96 times greater than their current liabilities. One possible

explanation is that their managers, who serve as unpaid volunteers, tend to avoid incurring

228