Page 261 - Social Enterprise A New Business Paradigm for Thailand

P. 261

In addition, tax registration status also appears to influence income performance. Social

enterprises registered for tax privileges with the Revenue Department, 94 enterprises, or

approximately 38% of those included in the study, reported an average total income of 41.54

million baht (24.19 + 17.35). By contrast, the 151 unregistered enterprises (around 62%) had an

average income of just 13.39 million baht (24.19 – 10.80), suggesting a notable income gap

based on tax registration.

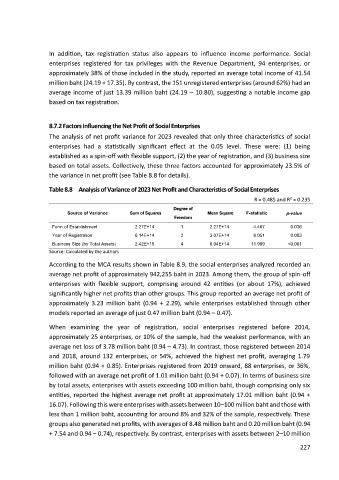

8.7.2 Factors Influencing the Net Profit of Social Enterprises

The analysis of net profit variance for 2023 revealed that only three characteristics of social

enterprises had a statistically significant effect at the 0.05 level. These were: (1) being

established as a spin-off with flexible support, (2) the year of registration, and (3) business size

based on total assets. Collectively, these three factors accounted for approximately 23.5% of

the variance in net profit (see Table 8.8 for details).

Table 8.8 Analysis of Variance of 2023 Net Profit and Characteristics of Social Enterprises

R = 0.485 and R² = 0.235

Degree of

Source of Variance Sum of Squares Mean Square F-statistic p-value

Freedom

Form of Establishment 2.27E+14 1 2.27E+14 4.467 0.036

Year of Registration 6.14E+14 2 3.07E+14 6.051 0.003

Business Size (by Total Assets) 2.42E+15 4 6.04E+14 11.909 <0.001

Source: Calculated by the authors

According to the MCA results shown in Table 8.9, the social enterprises analyzed recorded an

average net profit of approximately 942,255 baht in 2023. Among them, the group of spin-off

enterprises with flexible support, comprising around 42 entities (or about 17%), achieved

significantly higher net profits than other groups. This group reported an average net profit of

approximately 3.23 million baht (0.94 + 2.29), while enterprises established through other

models reported an average of just 0.47 million baht (0.94 – 0.47).

When examining the year of registration, social enterprises registered before 2014,

approximately 25 enterprises, or 10% of the sample, had the weakest performance, with an

average net loss of 3.78 million baht (0.94 – 4.73). In contrast, those registered between 2014

and 2018, around 132 enterprises, or 54%, achieved the highest net profit, averaging 1.79

million baht (0.94 + 0.85). Enterprises registered from 2019 onward, 88 enterprises, or 36%,

followed with an average net profit of 1.01 million baht (0.94 + 0.07). In terms of business size

by total assets, enterprises with assets exceeding 100 million baht, though comprising only six

entities, reported the highest average net profit at approximately 17.01 million baht (0.94 +

16.07). Following this were enterprises with assets between 10–100 million baht and those with

less than 1 million baht, accounting for around 8% and 32% of the sample, respectively. These

groups also generated net profits, with averages of 8.48 million baht and 0.20 million baht (0.94

+ 7.54 and 0.94 – 0.74), respectively. By contrast, enterprises with assets between 2–10 million

227