Page 260 - Social Enterprise A New Business Paradigm for Thailand

P. 260

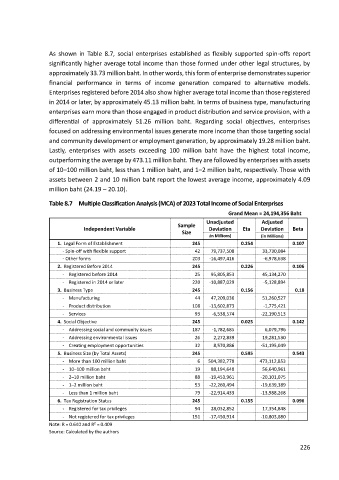

As shown in Table 8.7, social enterprises established as flexibly supported spin-offs report

significantly higher average total income than those formed under other legal structures, by

approximately 33.73 million baht. In other words, this form of enterprise demonstrates superior

financial performance in terms of income generation compared to alternative models.

Enterprises registered before 2014 also show higher average total income than those registered

in 2014 or later, by approximately 45.13 million baht. In terms of business type, manufacturing

enterprises earn more than those engaged in product distribution and service provision, with a

differential of approximately 51.26 million baht. Regarding social objectives, enterprises

focused on addressing environmental issues generate more income than those targeting social

and community development or employment generation, by approximately 19.28 million baht.

Lastly, enterprises with assets exceeding 100 million baht have the highest total income,

outperforming the average by 473.11 million baht. They are followed by enterprises with assets

of 10–100 million baht, less than 1 million baht, and 1–2 million baht, respectively. Those with

assets between 2 and 10 million baht report the lowest average income, approximately 4.09

million baht (24.19 – 20.10).

Table 8.7 Multiple Classification Analysis (MCA) of 2023 Total Income of Social Enterprises

Grand Mean = 24,194,356 Baht

Unadjusted Adjusted

Sample

Independent Variable Deviation Eta Deviation Beta

Size

(in Millions) (in Millions)

1. Legal Form of Establishment 245 0.254 0.107

- Spin-off with flexible support 42 79,737,508 33,730,084

- Other forms 203 -16,497,416 -6,978,638

2. Registered Before 2014 245 0.226 0.106

- Registered before 2014 25 95,805,853 45,134,270

- Registered in 2014 or later 220 -10,887,029 -5,128,894

3. Business Type 245 0.156 0.18

- Manufacturing 44 47,209,036 51,260,527

- Product distribution 108 -13,602,873 -1,775,421

- Services 93 -6,538,574 -22,190,513

4. Social Objective 245 0.025 0.142

- Addressing social and community issues 187 -1,782,685 6,079,796

- Addressing environmental issues 26 2,272,839 19,281,530

- Creating employment opportunities 32 8,570,886 -51,195,049

5. Business Size (by Total Assets) 245 0.595 0.543

- More than 100 million baht 6 504,382,778 473,112,853

- 10–100 million baht 19 88,194,648 56,640,961

- 2–10 million baht 88 -19,453,961 -20,101,075

- 1–2 million baht 53 -22,260,494 -19,639,389

- Less than 1 million baht 79 -22,914,433 -13,988,268

6. Tax Registration Status 245 0.155 0.096

- Registered for tax privileges 94 28,032,852 17,354,848

- Not registered for tax privileges 151 -17,450,914 -10,803,680

Note: R = 0.640 and R² = 0.409

Source: Calculated by the authors

226