Page 257 - Social Enterprise A New Business Paradigm for Thailand

P. 257

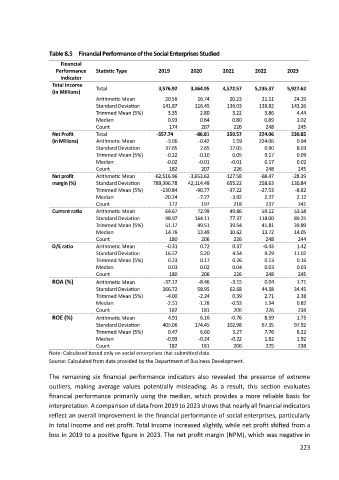

Table 8.5 Financial Performance of the Social Enterprises Studied

Financial

Performance Statistic Type 2019 2020 2021 2022 2023

Indicator

Total Income

Total 3,576.92 3,464.95 4,572.57 5,235.37 5,927.62

(in Millions)

Arithmetic Mean 20.56 16.74 20.23 21.11 24.19

Standard Deviation 141.87 116.45 136.03 139.82 143.26

Trimmed Mean (5%) 3.35 2.80 3.22 3.86 4.44

Median 0.93 0.64 0.80 0.89 1.02

Count 174 207 226 248 245

Net Profit Total -557.74 -86.81 359.57 224.06 230.85

(in Millions) Arithmetic Mean -3.06 -0.42 1.59 224.06 0.94

Standard Deviation 37.65 2.65 17.05 0.90 8.03

Trimmed Mean (5%) -0.22 -0.10 0.05 9.17 0.09

Median -0.02 -0.01 -0.01 0.17 0.02

Count 182 207 226 248 245

Net profit Arithmetic Mean -62,516.96 -3,653.62 -127.58 -68.47 -28.39

margin (%) Standard Deviation 789,396.78 42,114.49 655.22 258.63 130.84

Trimmed Mean (5%) -130.84 -90.77 -37.22 -27.53 -8.82

Median -20.24 -7.27 -3.92 2.37 2.12

Count 172 197 218 237 241

Current ratio Arithmetic Mean 64.67 72.99 49.86 59.12 53.58

Standard Deviation 98.97 164.11 77.37 118.00 89.25

Trimmed Mean (5%) 51.17 49.51 39.54 41.81 39.89

Median 14.76 13.49 10.62 13.72 14.05

Count 180 206 226 248 244

D/E ratio Arithmetic Mean -0.31 0.72 0.37 -0.43 1.42

Standard Deviation 16.57 5.20 4.54 9.29 11.02

Trimmed Mean (5%) 0.23 0.17 0.26 0.13 0.16

Median 0.03 0.02 0.04 0.03 0.03

Count 180 206 226 248 245

ROA (%) Arithmetic Mean -37.12 -8.46 -3.15 0.04 1.71

Standard Deviation 266.72 58.95 62.68 44.58 34.45

Trimmed Mean (5%) -4.00 -2.24 0.39 2.71 2.38

Median -2.51 -1.28 -0.53 1.34 0.82

Count 182 181 206 226 238

ROE (%) Arithmetic Mean 4.91 6.16 -0.76 8.59 1.75

Standard Deviation 405.06 174.45 102.98 67.35 97.92

Trimmed Mean (5%) 0.47 6.60 3.27 7.76 6.22

Median -0.93 -0.24 -0.22 1.82 1.92

Count 182 181 206 225 238

Note: Calculated based only on social enterprises that submitted data.

Source: Calculated from data provided by the Department of Business Development.

The remaining six financial performance indicators also revealed the presence of extreme

outliers, making average values potentially misleading. As a result, this section evaluates

financial performance primarily using the median, which provides a more reliable basis for

interpretation. A comparison of data from 2019 to 2023 shows that nearly all financial indicators

reflect an overall improvement in the financial performance of social enterprises, particularly

in total income and net profit. Total income increased slightly, while net profit shifted from a

loss in 2019 to a positive figure in 2023. The net profit margin (NPM), which was negative in

223