Page 205 - Social Enterprise A New Business Paradigm for Thailand

P. 205

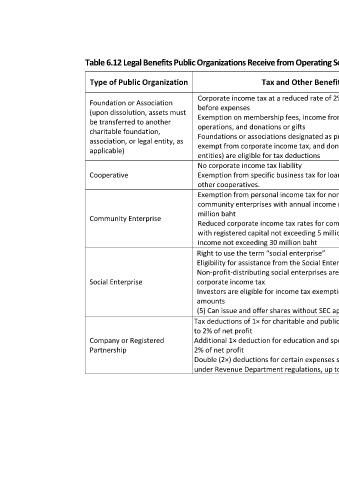

Table 6.12 Legal Benefits Public Organizations Receive from Operating Social Businesses

BOI Investment

Type of Public Organization Tax and Other Benefits Procurement Benefits

Promotion Benefits

(1) Corporate income tax at a reduced rate of 2%–10% of income

Foundation or Association before expenses

(upon dissolution, assets must

(2) Exemption on membership fees, income from private school Not eligible for BOI

be transferred to another

operations, and donations or gifts investment promotion

charitable foundation, Procurement benefits

association, or legal entity, as (3) Foundations or associations designated as public charities are under the government’s benefits

exempt from corporate income tax, and donors (individuals or

applicable) “specific method” for:

entities) are eligible for tax deductions

▪ certified organizations or

(1) No corporate income tax liability Local organizations

foundations for persons

Cooperative (2) Exemption from specific business tax for loans to members or (cooperatives,

with disabilities

other cooperatives. community enterprises,

▪ products from cooperative

(1) Exemption from personal income tax for non-legal-entity social enterprises, or

community enterprises with annual income not exceeding 1.8 stores or agricultural local farmer groups

institutions certified by the

million baht registered with relevant

Community Enterprise Ministry of Agriculture

(2) Reduced corporate income tax rates for community enterprises agencies) are eligible to

with registered capital not exceeding 5 million baht and annual ▪ products from village or receive at least 500,000

income not exceeding 30 million baht subdistrict occupational baht per project through

groups

(1) Right to use the term “social enterprise” BOI-supported

▪ products or services from

(2) Eligibility for assistance from the Social Enterprise Promotion Fund community and social

registered social

(3) Non-profit-distributing social enterprises are exempt from enterprises. development

Social Enterprise corporate income tax collaboration.

(4) Investors are eligible for income tax exemptions on investment

amounts

(5) (5) Can issue and offer shares without SEC approval

- Tax deductions of 1× for charitable and public benefit expenses up Businesses can propose

to 2% of net profit collaborative projects

Company or Registered - Additional 1× deduction for education and sports expenses up to with local organizations

Partnership 2% of net profit to apply for investment

- Double (2×) deductions for certain expenses specifically promoted promotion.

under Revenue Department regulations, up to 10% of net profit.

172