Page 181 - Social Enterprise A New Business Paradigm for Thailand

P. 181

they can produce. As a result, the foundation continues to seek additional sources of support to sustain

its work in the long term.

Source: Based on insights from the interview.

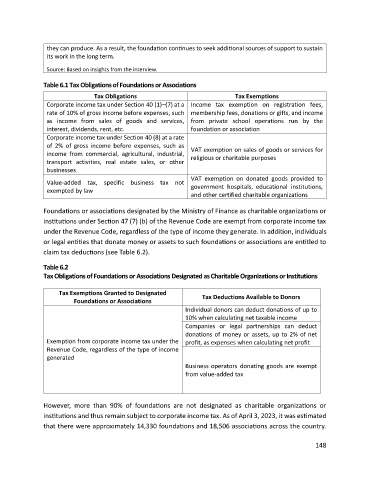

Table 6.1 Tax Obligations of Foundations or Associations

Tax Obligations Tax Exemptions

Corporate income tax under Section 40 (1)–(7) at a Income tax exemption on registration fees,

rate of 10% of gross income before expenses, such membership fees, donations or gifts, and income

as income from sales of goods and services, from private school operations run by the

interest, dividends, rent, etc. foundation or association

Corporate income tax under Section 40 (8) at a rate

of 2% of gross income before expenses, such as VAT exemption on sales of goods or services for

income from commercial, agricultural, industrial, religious or charitable purposes

transport activities, real estate sales, or other

businesses

VAT exemption on donated goods provided to

Value-added tax, specific business tax not

exempted by law government hospitals, educational institutions,

and other certified charitable organizations

Foundations or associations designated by the Ministry of Finance as charitable organizations or

institutions under Section 47 (7) (b) of the Revenue Code are exempt from corporate income tax

under the Revenue Code, regardless of the type of income they generate. In addition, individuals

or legal entities that donate money or assets to such foundations or associations are entitled to

claim tax deductions (see Table 6.2).

Table 6.2

Tax Obligations of Foundations or Associations Designated as Charitable Organizations or Institutions

Tax Exemptions Granted to Designated Tax Deductions Available to Donors

Foundations or Associations

Individual donors can deduct donations of up to

10% when calculating net taxable income

Companies or legal partnerships can deduct

donations of money or assets, up to 2% of net

Exemption from corporate income tax under the profit, as expenses when calculating net profit

Revenue Code, regardless of the type of income

generated

Business operators donating goods are exempt

from value-added tax

However, more than 90% of foundations are not designated as charitable organizations or

institutions and thus remain subject to corporate income tax. As of April 3, 2023, it was estimated

that there were approximately 14,330 foundations and 18,506 associations across the country.

148